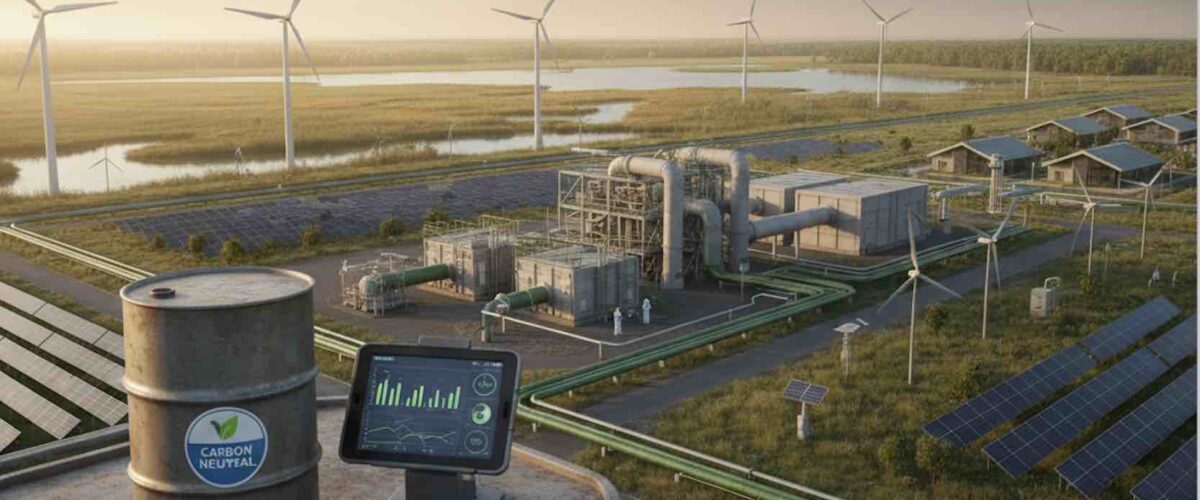

The global energy sector is undergoing a profound transformation. Increasingly stringent climate policies, investor pressure, and public demand for sustainability are pushing energy companies and traders toward carbon-neutral operations. For petroleum and energy traders, achieving carbon neutrality is not just an environmental goal; it is a strategic imperative that reshapes risk management, market opportunities, and operational models.

Understanding Carbon-Neutral Trading

Carbon-neutral trading refers to balancing greenhouse gas emissions generated by trading activities with equivalent carbon reductions or offsets. For energy traders, this can involve:

- Reducing emissions in physical operations such as shipping, storage, and transport.

- Utilizing low-carbon or zero-carbon fuels, including LNG, biofuels, and hydrogen.

- Investing in carbon credits or nature-based offsets to neutralize unavoidable emissions.

The goal is to maintain profitability while aligning with international climate targets, including the Paris Agreement’s net-zero ambitions.

Opportunities in the Carbon-Neutral Transition

- Market Differentiation and Reputation

Companies that embrace carbon-neutral trading enhance their brand credibility with clients, investors, and regulators. Sustainability credentials can open doors to partnerships and new markets, particularly with corporations seeking low-carbon fuel supply chains. - Access to Emerging Carbon Markets

Carbon pricing and trading are becoming increasingly mainstream. Traders can capitalize on carbon markets by buying, selling, and hedging carbon credits. These markets offer both risk management tools and new revenue streams. - Innovation in Low-Carbon Energy Products

Transitioning to carbon neutrality drives innovation, such as:- Trading renewable energy certificates (RECs) alongside fossil fuels.

- Expanding into biofuels, synthetic fuels, and hydrogen.

- Integrating data-driven tools to optimize logistics and minimize carbon footprints.

- Regulatory Alignment and Risk Reduction

Governments are introducing stricter emissions reporting and compliance requirements. Early adopters of carbon-neutral practices are better positioned to navigate regulatory landscapes, avoid penalties, and leverage incentives such as carbon credits or tax breaks.

Challenges in the Transition

- Measurement and Reporting Complexity

Calculating the carbon footprint of trading operations—covering shipping, storage, procurement, and upstream activities—is complex. Accurate measurement requires advanced data analytics and standardized methodologies. - Supply Chain Constraints

Procuring low-carbon fuels and ensuring green logistics can be challenging due to limited infrastructure, high costs, or a lack of consistent supply. - Financial Costs and Investment

Implementing carbon-neutral operations often requires upfront investments in technology, monitoring systems, and offsets, which may impact short-term margins. - Market Volatility and Policy Uncertainty

Carbon markets are still evolving, and policies differ across regions. Traders must navigate fluctuating carbon prices, changing regulations, and varying standards for certification.

Strategic Steps for Traders

- Adopt Carbon Accounting Tools: Implement digital platforms that track emissions across all operations.

- Engage in Low-Carbon Fuel Trading: Diversify portfolios to include biofuels, LNG, hydrogen, and other low-carbon alternatives.

- Leverage Offsets Strategically: Invest in high-quality carbon credits or local environmental projects to balance emissions.

- Collaborate Across the Value Chain: Work with suppliers, logistics partners, and clients to reduce emissions collectively.

The transition to carbon-neutral trading is inevitable for the energy sector. Traders who proactively integrate sustainability into strategy, operations, and risk management will not only comply with regulations but also gain a competitive advantage. While the challenges are significant, the opportunities from new markets to innovation leadership are equally compelling.

Carbon-neutral trading represents both a challenge and a strategic opportunity for the petroleum and energy trading industry. By embracing data-driven tools, low-carbon products, and collaborative solutions, traders can reduce environmental impact, manage risk, and create long-term value. The future of energy trading will be defined not just by price and supply but by sustainability, innovation, and the ability to operate responsibly in a carbon-constrained world.

Read more on Sparkview Energy:

Green Hydrogen: A Game Changer for Decarbonizing the Oil and Gas Industry

Carbon Capture and Storage: Transforming Emissions into Opportunity

Green Equipment: Reducing the Carbon Footprint of Petroleum Operations