The global oil and gas industry has long been a cornerstone of economic development, powering industries, transportation, and households across the globe.

With vast resources and substantial profits, it remains a key player in the energy sector.

However, as the world faces growing environmental concerns, there is increasing pressure on the industry to reconcile the demands for profitability with the need for sustainability.

Balancing these two critical priorities—ensuring business success while addressing environmental and social responsibilities—has become one of the most significant challenges facing oil and gas companies today.

This article explores how oil and gas operators are navigating the delicate balance between profitability and sustainability, the challenges they face, and the innovative strategies they are adopting to ensure their operations are both financially viable and environmentally responsible.

1. The Dual Challenge: Profitability and Sustainability

For oil and gas companies, profitability has historically been the primary focus, driven by the extraction and sale of fossil fuels. However, this has often come at the expense of environmental sustainability, with practices such as drilling, gas flaring, and oil spills raising significant concerns about the ecological impact of the industry.

In recent years, the concept of sustainability has taken on greater importance. Climate change, resource depletion, and public scrutiny have led to increasing calls for the oil and gas sector to reduce its carbon footprint and operate in an environmentally responsible manner. Governments and international organizations are introducing more stringent environmental regulations, and there is a growing demand from investors, consumers, and stakeholders for companies to demonstrate their commitment to sustainable practices.

Key Challenges:

– Environmental Impact: The environmental risks associated with oil and gas exploration and extraction, including emissions, spills, and habitat destruction, must be minimized.

– Cost Pressures: Sustainability initiatives often require significant investment in new technologies, equipment, and compliance measures, which can increase operational costs.

– Public Perception: The oil and gas industry faces increasing criticism for its role in global warming and environmental degradation. Companies must work to improve their image by demonstrating their commitment to sustainability.

-Long-Term Viability: As the world transitions to cleaner energy sources, oil and gas companies must plan for a future where demand for fossil fuels may decrease, requiring them to diversify their operations.

2. Integrating Sustainability into Business Strategy

Balancing sustainability with profitability requires a fundamental shift in how oil and gas companies approach their business models. While traditional models focused primarily on resource extraction and short-term profits, there is a growing recognition that long-term success depends on sustainable practices. Companies must integrate sustainability into their core operations, aligning their strategies with environmental, social, and governance (ESG) goals.

– Energy Transition and Diversification

One of the key strategies for balancing profitability with sustainability is embracing the energy transition. Many oil and gas companies are investing in renewable energy projects such as wind, solar, and geothermal to diversify their portfolios and reduce their reliance on fossil fuels. This diversification helps companies future-proof their business and mitigate risks associated with the declining demand for oil and gas.

– Carbon Capture and Storage (CCS): Another critical technology being embraced by the oil and gas sector is carbon capture and storage. CCS allows companies to capture carbon dioxide emissions from fossil fuel combustion and store them underground, reducing the impact on the climate. By investing in CCS technologies, companies can continue to extract fossil fuels while minimizing their carbon footprint.

– Hydrogen Production: Some oil and gas companies are exploring hydrogen as a clean energy alternative. Green hydrogen, produced using renewable energy sources, can replace natural gas in various industrial processes, helping reduce carbon emissions while opening up new revenue streams for oil and gas companies.

2. Efficient Resource Management

Efficient use of resources is another way to strike a balance between profitability and sustainability. By adopting advanced technologies and processes that improve operational efficiency, oil and gas companies can reduce waste, lower operational costs, and minimize environmental impact.

-Digitalization and automation are playing a key role in achieving these goals.

– Advanced Data Analytics: Companies are increasingly using data analytics and AI to optimize exploration, drilling, and production processes. Predictive maintenance, for instance, can reduce equipment failures and extend the life of assets, thereby lowering costs and reducing waste.

– Water Management: Water usage in oil and gas operations can have significant environmental impacts, particularly in arid regions. Companies are investing in technologies to recycle and reuse water, minimizing their consumption of freshwater resources and reducing the environmental burden.

3. Transition to Lower-Carbon Operations

The oil and gas industry is among the largest contributors to greenhouse gas (GHG) emissions globally. To address this, companies are increasingly focusing on reducing emissions through innovative technologies and operational changes.

-Electrification of Operations: Electrifying offshore platforms, drilling rigs, and other facilities using renewable energy sources can drastically reduce the carbon footprint of operations. Several companies are transitioning to solar and wind-powered rigs, helping to reduce reliance on diesel generators and lower emissions.

-Methane Reduction: Methane, a potent greenhouse gas, is often released during the extraction and transportation of oil and gas. Companies are investing in technologies to detect and reduce methane leaks, such as infrared cameras and drone surveillance, which can help prevent the release of this harmful gas.

-Sustainable Supply Chains: The sustainability of the oil and gas industry is also linked to its supply chain. Companies are increasingly working with suppliers who adhere to sustainability practices and ensure that products are sourced responsibly. This includes using low-carbon materials, reducing transportation emissions, and minimizing waste in the production process.

-The Role of Innovation and Technology

Innovation plays a critical role in helping the oil and gas sector navigate the balance between profitability and sustainability. New technologies are enabling companies to operate more efficiently, reduce their environmental footprint, and explore new business models that align with sustainability goals.

-Renewable Energy Integration

One of the most significant innovations in the sector is the integration of **renewable energy** into oil and gas operations. Offshore wind farms, for example, are being developed alongside oil and gas platforms, providing power to the platforms themselves while reducing emissions. This integration helps companies meet renewable energy targets and reduce their reliance on fossil fuels.

. Circular Economy

The concept of a **circular economy**—where waste materials are reused and recycled—is gaining traction in the oil and gas sector. By adopting circular economy principles, companies can reduce their environmental impact and create new revenue streams from by-products. For instance, petroleum by-products can be used in manufacturing plastics, and oil waste can be converted into biofuels.

. Green Technologies and Sustainability Reporting

Many companies are now adopting green technologies such as hydrogen production, biofuels, and energy-efficient equipment to reduce emissions and environmental impact. Alongside these technologies, companies are enhancing their sustainability reporting to be more transparent about their operations and their commitment to ESG principles. Reporting frameworks such as the Global Reporting Initiative (GRI) and Task Force on Climate-related Financial Disclosures (TCFD) are increasingly being adopted to ensure that companies are held accountable for their environmental and social impact.

4. Corporate Responsibility and Stakeholder Engagement

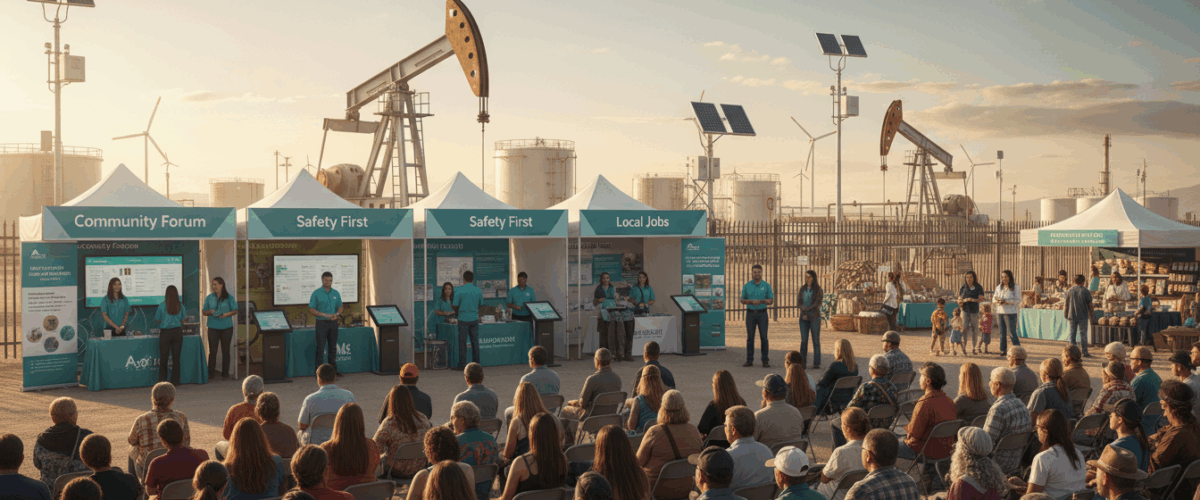

Sustainability is not just about environmental protection—it also involves social responsibility. Oil and gas companies are increasingly recognizing the importance of engaging with stakeholders, including local communities, environmental groups, and governments, to ensure their operations are aligned with broader societal goals.

– Community Engagement: Many oil and gas companies are investing in social programs that support local communities, such as educational initiatives, healthcare, and infrastructure development. These programs help companies build positive relationships with local stakeholders and ensure their operations contribute to the well-being of surrounding communities.

– Governance and Transparency: Companies are improving their governance frameworks by incorporating sustainability into their corporate culture. By maintaining transparency in their environmental, social, and governance practices, oil and gas companies can enhance their reputations and attract responsible investors.

5. Conclusion: A Path Toward Sustainable Profitability

Balancing profitability and sustainability in oil and gas operations is a complex but achievable goal. As the industry evolves, companies are adopting innovative technologies, reducing their carbon footprint, and diversifying into renewable energy sources to ensure long-term success. Sustainability is no longer a choice but a necessity for the future viability of the sector. By integrating sustainable practices into their business strategies, oil and gas companies can remain profitable while contributing to a cleaner, more sustainable world.

Ultimately, the key to success lies in the commitment to innovation, efficiency, and responsible governance. Oil and gas companies that embrace sustainability as an integral part of their operations will not only contribute to environmental preservation but also secure their place in an increasingly green and competitive global economy.

Read more on Sparkview Energy:

The Future of Offshore Oil Platforms: Innovations in Design and Sustainability

Environmental Impact of Oil and Gas Equipment: Mitigation and Sustainability Measures

Global Perspectives on Sustainable Energy Development