The petroleum industry, an essential pillar of the global economy, has long relied on the development and deployment of advanced equipment to explore, extract, and refine oil and gas.

From the earliest days of hand-powered drills to today’s cutting-edge smart technologies, the evolution of petroleum equipment has been marked by significant innovation.

As the industry faces new challenges such as environmental concerns, efficiency demands, and the need for safety in remote and hazardous environments, the role of advanced equipment has never been more crucial.

This article explores how petroleum equipment has evolved from traditional, manual tools to sophisticated smart devices and automated systems used in modern oil and gas operations, highlighting key technological advancements and their impact on the industry.

1. The Early Days: Manual Tools and Simple Machines

In the early stages of the petroleum industry, exploration and extraction relied heavily on simple mechanical devices and human labor. In the late 19th and early 20th centuries, the process of drilling for oil was rudimentary, and equipment was often designed with limited technology.

– The Hand-Operated Drill: One of the first tools used in drilling for oil was the rotary drilling rig, a simple device powered by human effort or basic engines. These rigs were manually operated and required significant human labor to maintain and operate.

– The Early Pumpjack: As the industry advanced, the invention of the pumpjack or nodding donkey*(a mechanical pump used to lift oil to the surface) was a breakthrough. These devices utilized a system of levers and pulleys to pump crude oil from a well, marking an early example of automation in the petroleum sector.

At this point, petroleum equipment was largely mechanical, and while it was crucial for production, it was still limited in its ability to address the increasingly complex demands of the growing industry.

2. The Rise of Automation: Mid-20th Century to 1990s*

By the mid-20th century, the petroleum industry experienced a major shift with the introduction of electrical** and hydraulic technologies that allowed for the automation of many processes. This period also saw the development of more specialized machinery for drilling, refining, and transporting oil.

Automated Drilling and Refining Equipment

– Rotary Drilling Rigs: The rotary drilling rig evolved into a more sophisticated version that included a drill bit controlled by electric and hydraulic systems, enabling faster and more efficient drilling. These rigs also became capable of drilling deeper wells, reaching more challenging geological formations.

-Enhanced Refining Processes: In refining, automation helped streamline the process of distilling, cracking, and purifying petroleum products. Control systems became more advanced, allowing for tighter control over temperature, pressure, and chemical reactions in refineries.

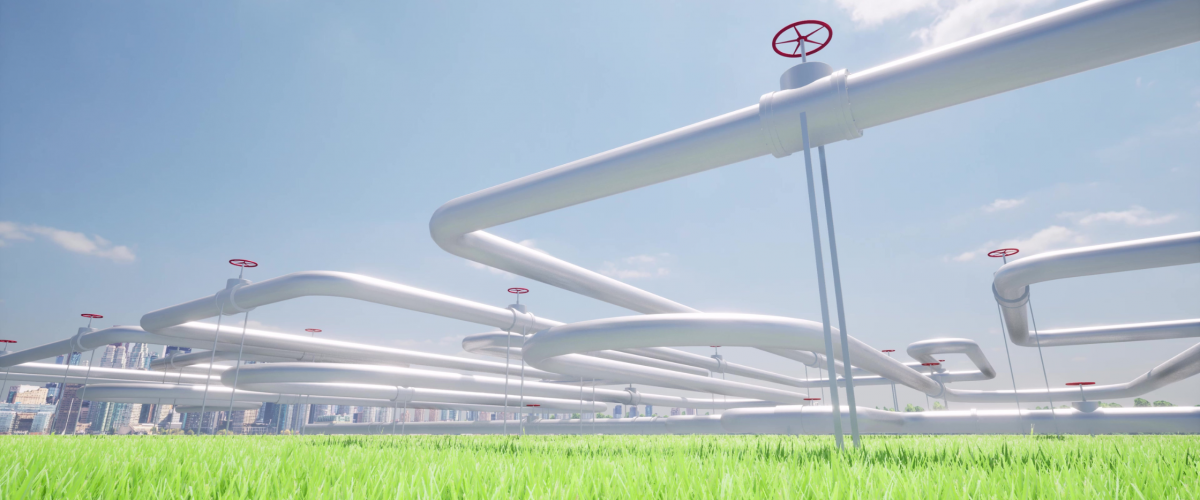

– Pump Systems and Pipelines: The introduction of automated pump systems for transporting petroleum through pipelines revolutionized the way oil was moved from one location to another. The incorporation of valves, sensors, and electric-powered pumps greatly reduced the need for manual labor and increased operational efficiency.

This period marked the increasing use of electric motors, hydraulics, and other power systems, improving productivity and safety in petroleum operations. Automation also allowed for deeper exploration in offshore and onshore drilling, reducing the physical risks to workers.

3. Digitalization and Precision: Early 2000s to 2010s

As the global energy demand grew and the industry faced increased environmental regulations and safety concerns, the petroleum sector began to embrace digitalization. The introduction of **computerized systems, data analytics, and **advanced sensors** transformed the way the equipment was operated, monitored, and maintained.

The Advent of Real-Time Monitoring

-Supervisory Control and Data Acquisition (SCADA): SCADA systems allow operators to monitor and control drilling operations remotely, in real-time, from central command centers. This led to a major leap in terms of operational efficiency and decision-making, as real-time data could be used to optimize processes and prevent failures.

– Advanced Sensors and IoT: The use of Internet of Things (IoT) sensors in petroleum equipment became widespread during this period. These sensors collect data on parameters like temperature, pressure, and flow rate, and relay that information to operators. For example, downhole sensors are now used to monitor well conditions, providing data that can help optimize drilling techniques and improve overall well performance.

-Automated Drilling Systems: During the 2000s, fully automated drilling systems emerged. These systems could adjust drilling parameters in real-time based on the data provided by sensors, improving precision and efficiency while reducing human error.

The introduction of digital technologies not only improved efficiency but also enhanced safety, as operators could now detect and respond to issues before they become catastrophic. In addition, these innovations allowed for predictive maintenance minimizing downtime and reducing maintenance costs by identifying potential equipment failures early on.

4. The Rise of Smart Equipment: 2010s to Present

As the petroleum industry entered the 21st century, the evolution of petroleum equipment took a dramatic leap with the advent of smart technologies. Smart equipment, which combines advanced sensors, artificial intelligence (AI), and machine learning, is now enabling the oil and gas industry to achieve levels of automation, precision, and efficiency that were once unimaginable.

Smart Drilling Systems

One of the most notable advancements has been the development of smart drilling systems, which integrate real-time data with machine learning algorithms to optimize drilling processes continuously. These systems can automatically adjust drilling parameters, manage well trajectories, and predict potential issues, all while reducing the need for manual intervention.

-Automated and Autonomous Rigs: Offshore platforms and onshore rigs are becoming more autonomous, with robots and drones taking over hazardous tasks such as routine inspections, maintenance, and even drilling. Autonomous rigs equipped with AI can make real-time decisions, maximizing the efficiency of the operation while reducing human risk.

-AI-Powered Predictive Maintenance: AI and machine learning algorithms are used to predict when equipment is likely to fail or require maintenance, allowing companies to perform preventive repairs before costly breakdowns occur. This approach not only minimizes downtime but also extends the lifespan of the equipment.

-Remote Operations and Digital Twins: The use of digital twin technology has allowed for the creation of virtual replicas of oil and gas equipment. These digital twins can be monitored and analyzed in real-time, providing operators with detailed insights into equipment performance, operational efficiency, and potential risks. This technology is particularly valuable for offshore platforms and remote locations where it’s difficult to have constant human oversight.

Smart Pipelines and Safety Systems

Smart pipelines are now equipped with sensors that monitor the integrity of the pipeline in real-time, detecting leaks, corrosion, and pressure drops before they lead to failures. These systems are integrated with central control rooms and can trigger automatic shutdowns to prevent disasters.

Additionally, smart safety systems are becoming more widespread in offshore and onshore environments. These systems use real-time data to monitor environmental conditions, assess potential risks, and automatically initiate safety protocols, ensuring the safety of workers and the environment.

5. Sustainability and Environmental Impact

As the global push for sustainability intensifies, the petroleum industry is incorporating green technologies into its operations. New equipment and systems are designed not only for efficiency and cost reduction but also to minimize environmental impact.

-Carbon Capture and Storage (CCS): Advanced petroleum equipment is now being developed to capture and store carbon emissions from oil and gas operations. These technologies are integrated into production equipment, ensuring that operations can comply with increasingly stringent environmental regulations.

– Energy-Efficient Equipment: The demand for energy-efficient equipment has led to the development of low-emission drilling rigs, renewable-powered operations, and equipment that reduces water and energy consumption.

By adopting green technologies, the petroleum industry is addressing environmental concerns while continuing to meet the world’s growing energy needs.

6. The Future of Petroleum Equipment

The evolution of petroleum equipment is far from over. Looking ahead, the industry is likely to see even greater integration of artificial intelligence (AI), machine learning, and blockchain technology. AI will continue to optimize drilling operations, while blockchain may enhance transparency and security in supply chains.

The future of petroleum equipment will also see greater automation and remote operations, with fewer human workers needed in hazardous environments. As the world shifts toward cleaner energy solutions, the petroleum industry will continue to innovate to meet sustainability goals while ensuring the efficient extraction and use of resources.

From hand-operated drills to AI-powered smart systems, the evolution of petroleum equipment reflects the industry’s ongoing adaptation to new challenges and opportunities.

Today’s petroleum equipment is more efficient, safer, and environmentally friendly than ever before.

As technology continues to advance, the oil and gas industry will remain at the forefront of innovation, using smart devices and cutting-edge technologies to drive sustainability and meet the world’s energy needs responsibly and efficiently.

The future promises even greater progress, with equipment that is not only smarter but also greener, helping the industry navigate the complex landscape of global energy demands.

Read more on Sparkview Energy:

Natural Gas Compression: Equipment and Applications in the Midstream Sector

Remote Sensing and Monitoring in the Oil and Gas Industry: Real-time Equipment Insights

Modernizing Oil Refineries: Upgrading Equipment for Higher Yields and Energy Efficiency